iowa state income tax calculator 2019

We strive to make the calculator perfectly accurate. The 2022 rates range from 0 to 75 on the first 34800 in wages paid to each employee in a calendar year.

Hawaii Income Tax Hi State Tax Calculator Community Tax

Ad Free Tax Calculator.

. Ad Use The Tax Calculator to Estimate Your Tax Refund or the Amount You May Owe The IRS. Many of Iowas 327 school districts levy an income surtax that is equal to a percentage of the Iowa taxes paid by residents. See What Credits and Deductions Apply to You.

This income tax calculator can help estimate your average income tax rate and your salary after tax. Estimate Your Tax Refund. ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as.

Include your 2019 Income Forms with your 2019 Return. Filing 6000000 of earnings will result in 459000 being taxed for FICA purposes. Enter Your Tax Information.

Read across to the column marked Your Tax Is Enter the amount on line 39. The 2019 Tax Calculator uses the 2019 Federal Tax Tables and 2019 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. Your average tax rate is 1198 and your marginal tax.

31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. Your AMT tax is calculated as 26 of AMTI up to 199900 99950 for married couples filing separately plus 28 of all AMTI over 199900 99950 for married couples filing separately. Iowa has a population of over 3 million 2019 and is the leading producer of corn in the world second to China.

Additional withholding cannot exceed your taxable wages less your federal withholding for a pay period. Your outstanding tax bill is estimated at 4244. 2019 Iowa Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

As an employer in Iowa you have to pay unemployment insurance to the state. If you make 70000 a year living in the region of Iowa USA you will be taxed 14177. Please use the calculators report to see detailed calculation results in tabular form.

The median household income is 58570 2017. After a few seconds you will be provided with a full breakdown of the tax you are paying. If youre a new employer congratulations you pay a flat rate of 1.

Your taxes are estimated at 4244. Select Region United States. The provided information does not constitute financial tax or legal advice.

So make sure to file your. The state income tax rate in Iowa is progressive and ranges from 033 to 853 while federal income tax rates range from 10 to 37 depending on your income. This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax.

You can quickly estimate your Iowa State Tax and Federal Tax by selecting the tax year your filing status Gross Income and Gross Expenses this is a great way to compare salaries in Iowa and. 2022 Tax Calculator Estimator - W-4-Pro. State Tax Tables for 2019 displayed on this page are provided in.

To use our Iowa Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Certain circumstances may cause the amount of Iowa withholding tax calculated by the withholding calculator to differ from a. Fields notated with are required.

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. Here are over 10 more 2019 Tax Calculator tools that give you direct answers on your personal tax questions. Resident of Appanoose countty need to pay 1 local income tax.

IA 1040 - Iowa Individual Income. Create Your Account Today to Get Started. This is 849 of your total income of 50000.

If you would like to update your Iowa withholding amount file the 2022 IA W-4 44-019 form with your employer. Your total tax payments for the year were 0. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

Our income tax and paycheck calculator can help you understand your take home pay. Iowa tax reform legislation enacted earlier in 2019 SF 2417 reduced state income tax rates across the board effective January 1 2019 and generally conformed Iowas individual income tax laws to the federal Internal Revenue Code IRC including changes under the Tax Cuts and Jobs Act TCJA beginning with tax year 2019. This results in roughly 13431 of your earnings being taxed in total although depending on.

The Iowa State Tax Calculator IAS Tax Calculator uses the latest Federal tax tables and State Tax tables for 202223To estimate your tax return for 202223 please select the 2022 tax year. What is the income tax rate in Iowa. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Read down the left column until you find the range for your Iowa taxable income from line 38 on form IA 1040. Your taxes are estimated at 4244 Column Graph. If the AMT tax calculation results in an amount that is greater than your normal income tax you owe the difference as AMT.

2019 IA 1040 TAX TABLES For All Filing Statuses To find your tax. Iowa State Income Tax Forms for Tax Year 2021 Jan. So if you pay 2000 in Iowa state taxes and your school district surtax is.

- Iowa State Tax. New construction employers pay 75. Iowa Income Tax Calculator 2021.

After July 15 2023 you will no longer be able to claim your 2019 Tax Refund through your Tax Return. 54-130a - Iowa Rent Reimbursement Claim. Click for the 2019 State Income Tax Forms.

The income tax rate ranges from 033 to 853. Filing 6000000 of earnings will result in 265358 of your earnings being taxed as state tax calculation based on 2021 Iowa State Tax Tables. Appanoose County has an additional 1 local income tax.

Iowa state income tax. How to calculate Federal Tax based on your Annual Income.

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

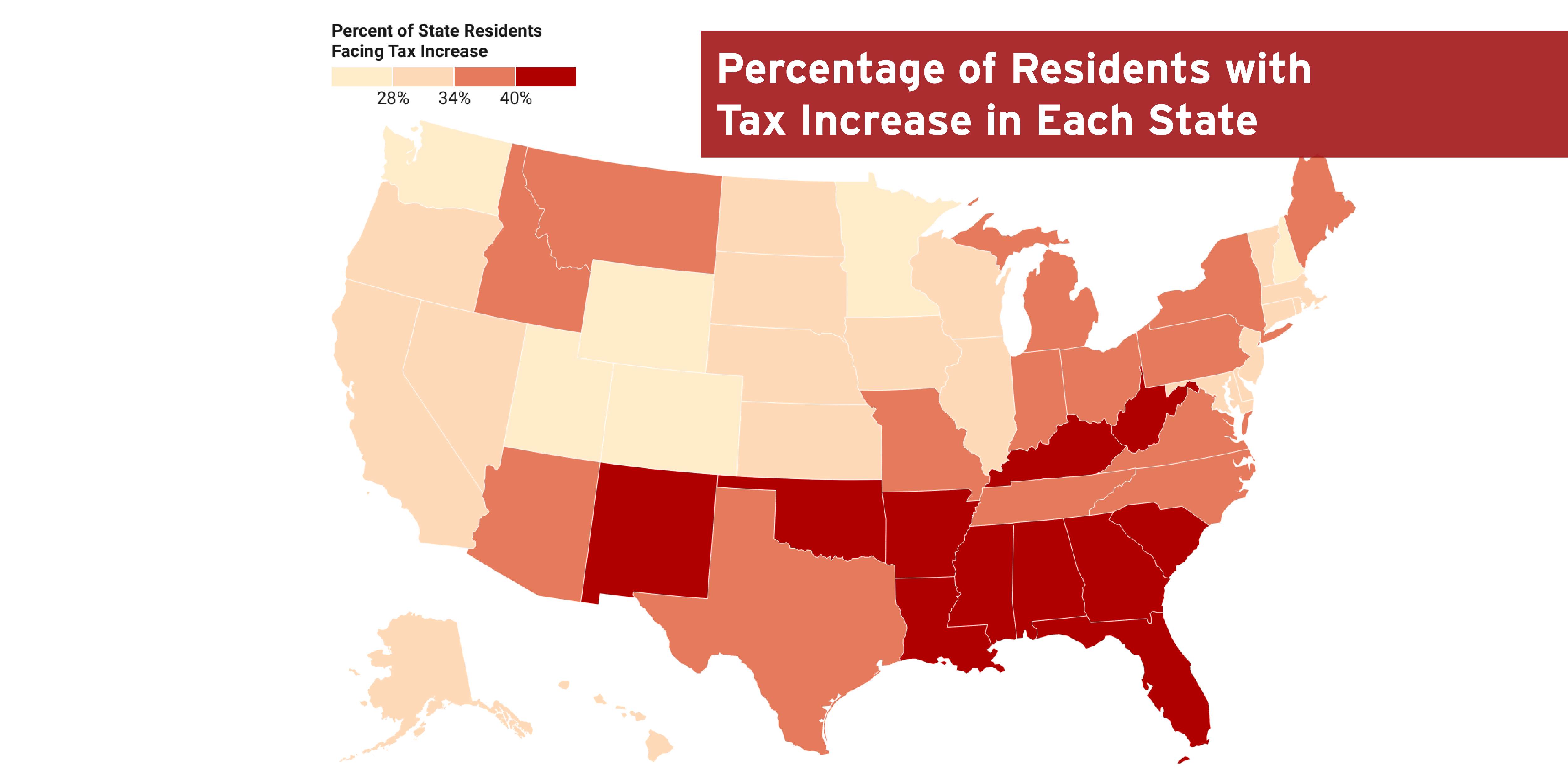

State By State Estimates Of Sen Rick Scott S Skin In The Game Proposal Itep

Which States Pay The Most Federal Taxes Moneyrates

Tax Calculator Estimate Your Taxes And Refund For Free

Iowa Income Tax Calculator Smartasset

County Surcharge On General Excise And Use Tax Department Of Taxation

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

How Do State And Local Individual Income Taxes Work Tax Policy Center

How Do State And Local Individual Income Taxes Work Tax Policy Center

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

States With Highest And Lowest Sales Tax Rates

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

You May Not Want To Hear How Much Money You Have To Make To Live In Colorado Map Usa Map 30 Year Mortgage

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)